Fortunately, when things start to go wrong, title insurance can protect you from anything that stands between you and that dream home. Here are three nightmare scenarios that demonstrate why you need title insurance:

The Mysterious Second Seller

Many would assume that the individual or people selling their home to you would, in fact, be the owners. Sounds reasonable enough. However, sometimes the original seller has hidden baggage in the form of incomplete or nonexistent ownership.

Many would assume that the individual or people selling their home to you would, in fact, be the owners. Sounds reasonable enough. However, sometimes the original seller has hidden baggage in the form of incomplete or nonexistent ownership.In the event that a relative lays claim to your potential new home, you have to negotiate, buy them out, or go to court to duke it out. If a judge rules in favor of the other party, you can lose out on your down payment and any portion of your principal balance paid towards the home.

While a lender's title insurance policy will protect the bank against any costs incurred, this doesn't help you at all. Alternatively, an owner's title insurance policy covers you against any accrued losses, allowing you to walk away as if you never heard of the property, to begin with.

Neighborly Quarrels

We aren't destined to be guaranteed perfect neighbors in life, but some neighbors are better than others. In the event, that your prospective neighbors add to their property and it overlaps onto yours, you can have issues. If this occurs prior a home closing, title insurance will cover the costs needed to resolve the issue out of court.

Hidden Mortgages & Unpaid Taxes

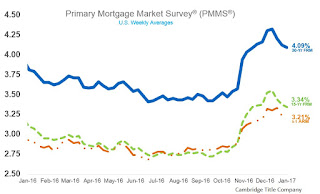

While Cambridge Title Company has an excellent system for conducting a title search on a property, other systems may not uncover incorrectly posted mortgages. If you find yourself saddled with this situation and you have owner's title insurance, file a claim and your policy will take care of the mortgage. Otherwise, you're stuck with the extra costs.

Similarly, if the seller had unpaid taxes on the property and you receive a delinquency notice following the closing, you will be stuck with the taxes. That is unless you have owner's title insurance.

Summary

Life is full of unexpected circumstances. Similar to any other type of insurance that you've purchased in the past, owner's title insurance is there to protect you against life's "what-if's".

For more information on purchasing title insurance, contact Cambridge Title Company by phone at 224-330-1886 or by email at info@cambridgetitleco.com.