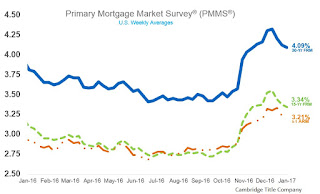

Along with the 30-year fixed mortgage rate, Freddie Mac's survey indicates that the 15-year fixed mortgage rate and the 5-year Treasury-indexed hybrid adjustable-rate mortgage also saw declines this past week. The 15-year FRM declined from 3.37% to 3.34%. The 5-year ARM decreased from 3.23% to 3.21%.

So how has this impacted mortgage applications as a whole? According to the Washington Post, "Both refinance and purchase application volume has trended down over the past three weeks, after rate reductions spurred by the Brexit vote drove increased activity,” said Lynn Fisher, the MBA’s vice president of research and economics. “As the total pool of borrowers who can benefit from a refinance continues to shrink, we continue to see weeks where small declines in average mortgage rates like we saw last week do not spur additional mortgage application activity."

In essence, even with the decline in mortgage rates, mortgage applications are not trending upward. For additional questions on mortgage rates and how they may impact you as a prospective home buyer, contact Cambridge Title Company at 224-330-1886 or at info@cambridgetitleco.com.

No comments:

Post a Comment