|

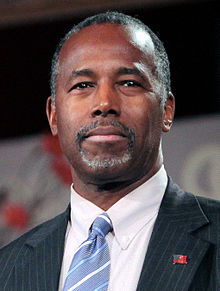

Fast forward to January 12th, 2017, Ben Carson sat for his hearing with the United States Senate Banking, Housing, and Urban Affairs Committee. While Dr. Carson, doesn't have any formal experience relating to the role in question, CNN reported that he spoke to his impoverished upbringing growing up in Detroit's inner city region.

In addition, CNN reports, "He also looked to quell concerns about his qualifications with a letter from four past HUD secretaries, including a Democrat who served in President Bill Clinton's administration, urging his confirmation."

As far as his platform goes, Ben Carson has two clear beliefs:

- Government programs benefiting those in need encourages dependency on the government for livelihood.

- He is against housing discrimination, noticeably speaking to discrimination against individuals from the LGBTQ community.

On January 24th, Ben Carson received unanimous approval for a full Senate vote. While it's likely that Ben Carson will be officially approved as Secretary of Housing and Urban Development, time will tell what his actual intentions are.

For questions on title and escrow services relating to real estate sale or mortgage transactions, contact Cambridge Title Company by phone at 224-330-1886 or via email at info@cambridgetitleco.com.